AutoFi: Show and Sell with Confidence

AutoFi brings the power of real financing to every stage of the car-buying journey. With soft credit pulls, personalized payments, and instant lender decisioning, AutoFi gives customers the confidence to shop—and dealers the tools to close. Dealers leveraging AutoFi’s platform consistently see 20%+ close rates from digital leads, higher application-to-sale conversion, and increased CSI scores driven by a faster, more transparent experience.

Built for both scale and flexibility, AutoFi integrates seamlessly with your CRM, OEM system and RouteOne or DealerTrack. And with the addition of AI-powered innovations like AutoFi Discover and AutoFi Engage, plus popular features such as Collaborative Deal Sharing, dealers can now deliver a truly connected experience that unites customers and sales teams from the first quality response to delivery.

Compare Packages Enroll

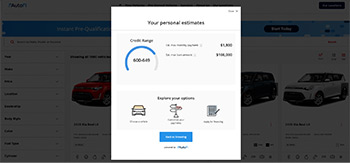

Credit and Financing

The Foundation of True Digital Retail

For most consumers, credit and financing are the most uncertain parts of car buying. AutoFi removes that uncertainty by giving shoppers clarity, confidence, and real purchasing power, while keeping dealers in complete control.

The built-in Credit Estimator provides instant credit insight through soft credit pull and lender programs and trends, helping customers understand their buying power without impacting their credit. Dealers can display accurate payments based on live lender data and integrate directly with RouteOne and Dealertrack for a seamless financing experience.

With AutoFi’s breadth of financing features, from pre-qualification and payment transparency to instant approvals, dealers can serve every type of shopper, from first-time buyers to returning customers. AutoFi dealers routinely achieve lead-to-sale conversion rates exceeding 20%, reducing time-to-close while delivering the confidence and transparency today’s consumers expect.

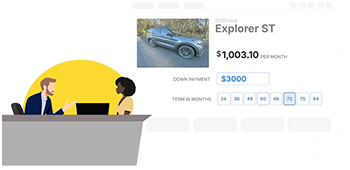

Seamless Online-to-Showroom Experience

Consistency That Builds Confidence

AutoFi bridges online exploration and in-store execution with one connected workflow. Consumers can start a deal online, then pick up right where they left off in the showroom, with all data, approvals, and payment details carried through. Dealers report higher closing efficiency and improved CSI scores, thanks to fewer handoff errors and a frictionless customer experience.

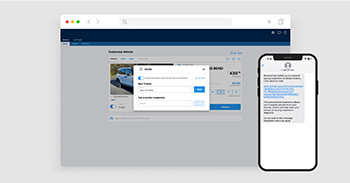

Collaborative Deal Sharing

Connect Customers and Sales in Real Time

AutoFi’s collaborative deal sharing feature lets dealers instantly send personalized, transactable deals to customers via text or email. Shoppers can review real payments, adjust terms, and finalize details remotely, while the dealership retains full control over pricing and lender options. Dealers use this feature to keep deals alive after hours, re-engage cold leads, and close more customers faster—turning convenience into conversion.

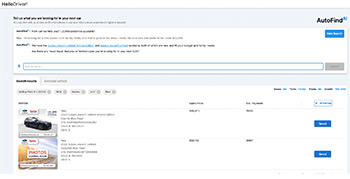

AutoFi Discover* New Feature available February 2026!

AI-Powered Consumer Shopping Experience on your website

AutoFi Discover turns dealership websites into conversational showrooms. Shoppers simply ask, “I have some credit challenges but need a truck under $700/month” and instantly see personalized vehicles with accurate, financeable payments. By combining natural-language interaction with AutoFi’s proven finance engine, Discover converts curiosity into qualified leads, syncing results directly to the Dealer Portal and CRM.

Core Value:

- Enhances website engagement and lead quality

- Generates real, finance-ready quotes instantly

- Delivers richer shopper context to sales teams

AutoFi Engage* New Feature available February 2026!

AI-Driven Dealer Assistant

AutoFi Engage empowers BDC, Internet, and Sales teams to instantly identify the right vehicles, deliver compliant payment quotes, and maintain consistent follow-through from first contact to close. Dealers using Engage shorten response times, increase quoting accuracy, and improve close rates across all channels.

Core Value:

- Accelerates lead response and deal velocity

- Provides transparent, payment-backed quotes

- Enables seamless collaboration across teams

Dealer Control

Flexibility, Transparency, and Confidence

AutoFi is built to support the dealer’s process, not replace it. Dealers maintain full control over deal structures, lender routing, markups, and credit-tier rules, ensuring every transaction aligns with store strategy and OEM compliance standards. AutoFi provides the infrastructure; the dealer stays in the driver’s seat.

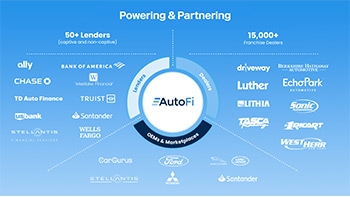

Proven Partnerships

Trusted by Leading OEMs and Lenders

AutoFi powers digital retail programs across major OEM and lender networks, supporting thousands of dealerships nationwide. Our platform is built for enterprise-grade scalability, meeting the rigorous data, security, and compliance standards required by the industry’s most trusted brands.